Scuba divers are taught very early on safety and emergency procedures. While scuba diving is generally safe when we mindfully apply them, still there is a risky nature in our favorite sport.

However, beyond everyone’s personal health, remember that we must not scuba dive alone. Involuntarily you could cause personal or material damage to another diver underwater, on the boat, or at the dive center. Hence, third-party liability insurance can save you from a legal nightmare.

Sure, you could accumulate all sorts of insurance plans without bothering too much and hope for the best in case something happens. But don’t you want to know?

Let’s take a look at some factors to consider when getting Diving Insurance for yourself.

- Accident Medical Expense Coverage

- This is for any treatment, physician, hospital charges, and emergency transportation via ground, air, or marine ambulance.

- Accidental Death & Dismemberment

- Must include coverage for loss of life or limb resulting from a diving or water sports accident while on a trip.

- Permanent & Total Disability

- If one is permanently unable to return to work due to a diving or water sports accident.

- Search & Rescue Coverage

- To support the Coast Guard, local police, or the efforts of other international services to locate you at sea when accidents occur.

- Extra Accommodation & Transportation

- Made for covering extra airfare, hotels, meals, and incidentals if your return travel is delayed due to treatment prescribed by a doctor.

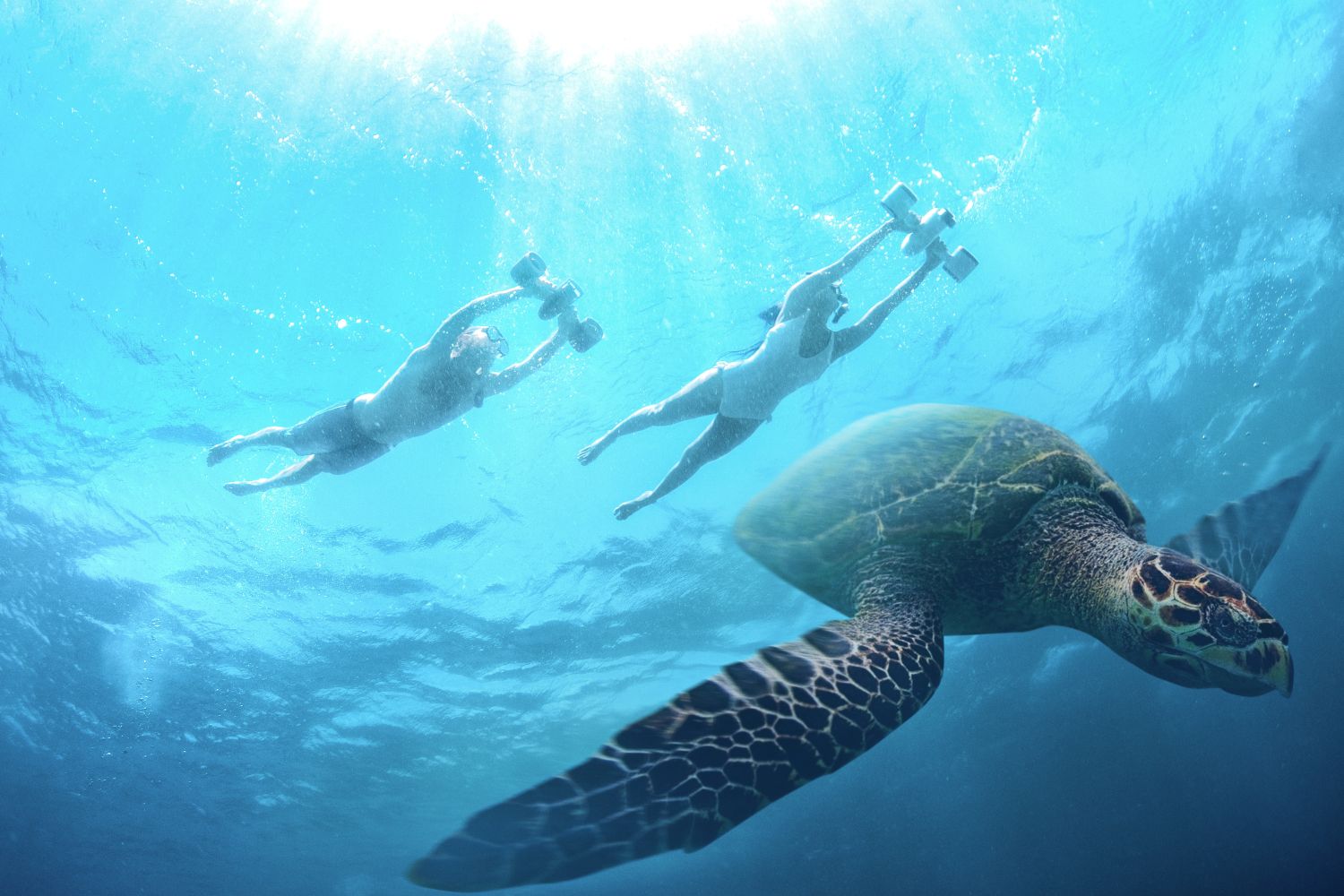

- Lost Diving Equipment

- Coverage for any equipment such as a regulator, DPV (Diver Propulsion Vehicle), dive computer, etc. that are unintentionally lost or damaged during accidents.

Beyond money, the nature of diving risks involves specialized knowledge that not all doctors have. Relying on an organization whose consultants are diving medical experts to coordinate your treatment, even remotely, can have a tremendous impact on how you will recover.

Make sure you read the policy carefully, ask lots of questions and understand exactly what you’re covered for—especially if you’re traveling to a developing or remote location.

Share:

Can I Travel on an Airplane with an Underwater Scooter?

Diving as a Leisure and as a Profession